Market Scorecard

What day is it? If you are feeling confused you are not alone. We are in for a three day work week in South Africa, making us feel even more disorientated! Looking at markets, the S&P 500 has recovered back to where it was on the 10 March. Even though it has been steadily climbing, it still needs to rise by another 17% to get back to where it was at the end of February. Influencing where stocks go next will be the guidance given by US companies reporting over the next few weeks. Expect volatility ahead as more data comes in from companies and from governments.

On Friday the JSE All-share closed down 0.15% and yesterday the S&P 500 closed up 1.47%, and the Nasdaq closed up 1.11%.

Our 10c Worth

One thing, from Paul

The economic fallout of the Covid-19 outbreak and lockdown is widespread and unrelenting. The sectors that are arguably worst affected are those that are based on social activities such as tourism, travel, mass entertainment, conferences and eating in restaurants. Small businesses in this part of the economy are also much worse off than big ones, because they tend to operate on tighter profit margins and have minimal capital reserves.

This account by a restaurant owner in the East Village, a neighbourhood in Manhattan in New York, is beautifully written. The owner of Prune, a tiny bistro recounts the story of the founding and expansion of the establishment, and its recent closing due to virus-related restrictions. She had a staff of 30 employees, all of whom were laid off.

Keep in mind that retrenched staff and struggling small businesses in the US have access to substantial state-provided bailout benefits, loans and unemployment insurance. Here in South Africa such benefits are either not provided at all, or painfully hard to access due to bungled application systems.

Read Gabrielle Hamilton’s account on the New York Times website: My Restaurant Was My Life for 20 Years. Does the World Need It Anymore? There might be light at the end of the tunnel. According to Google Maps, the restaurant has re-opened since the article was written.

Byron’s Beats

Last month I bought myself some Peloton shares. Once you have skin in the game, you follow a company a lot closer. That is normally how our investment process works. If you forgot, Peloton sells at home interactive gym classes, mostly on a stationary bike.

My reason for buying them is self explanatory during the lockdown. But there are never any obvious secrets in the markets. To make money the numbers need to beat these “obvious” expectations. I am not buying the share because I think there will be a short term spike. I bought it because I believe this new customer lockdown boost, will lead to this style of exercising catching on post lockdown. The good user experience will lock in many more monthly subscribers for years to come.

I am also aware of the risks. The company runs at a loss and is still small ($9bn market cap). The share has been very volatile since listing in September last year. Over the weekend I was especially happy to see that the company hit a record 23 000 people attending one single online class last week Wednesday. The company now has 2 million members worldwide. Hopefully it comes to SA soon!

Michael’s Musings

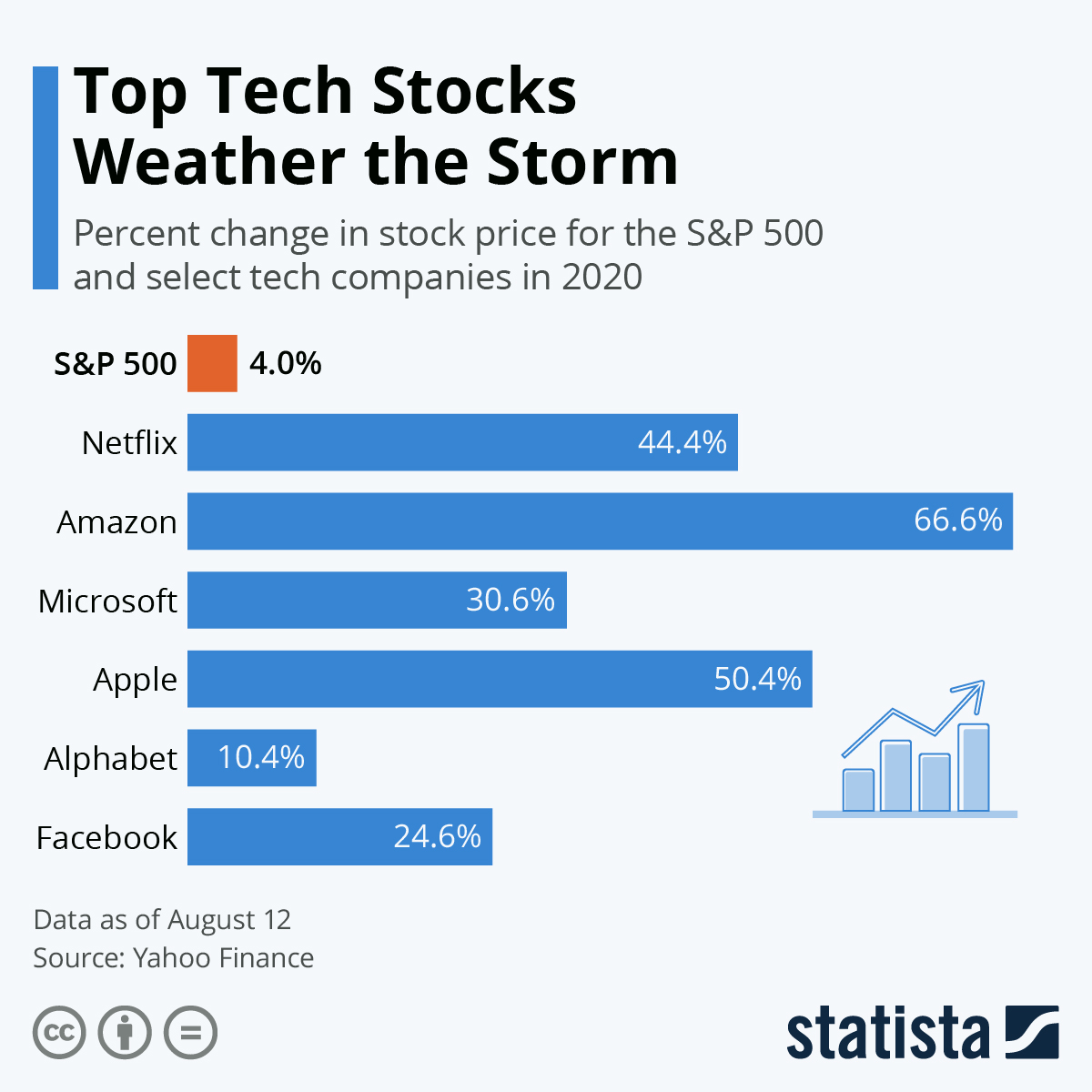

On average, technology stocks have done very well during this crisis/ lockdown. Many tech companies are sitting on massive piles of cash. Money in the bank is a good thing when business slows down. It means that you can survive the winter and continue growing when spring comes around again. One reason they have all the cash is because they are capital light businesses, meaning all the money that they make isn’t needed for the firm to continue growing. For Facebook to add users, they just need to add a few cheap servers, and they can keep growing. Compare that to a manufacturing business, which needs to invest in property and machinery if it wants to grow.

On top of the massive cash balances, some tech companies are seeing a surge in their usage. In the current environment, Amazon is surging because it is safer to use online delivery than to go to the shop. Looking at Netflix, what would we do with our time if we didn’t have endless series and movies to watch?

The laggard in the group is Facebook. Note that it is still performing better than the overall market though. As Paul wrote about last week (Facebook’s Increased Usage In Lockdown), Facebook is seeing a surge in usage, but a decline in advertising spend.

Overall, being overweight the technology industry has been a very good thing for Vestact clients. The graphic below from Statista shows how some of the heavyweights have performed.

You will find more infographics at Statista

You will find more infographics at Statista

Bright’s Banter

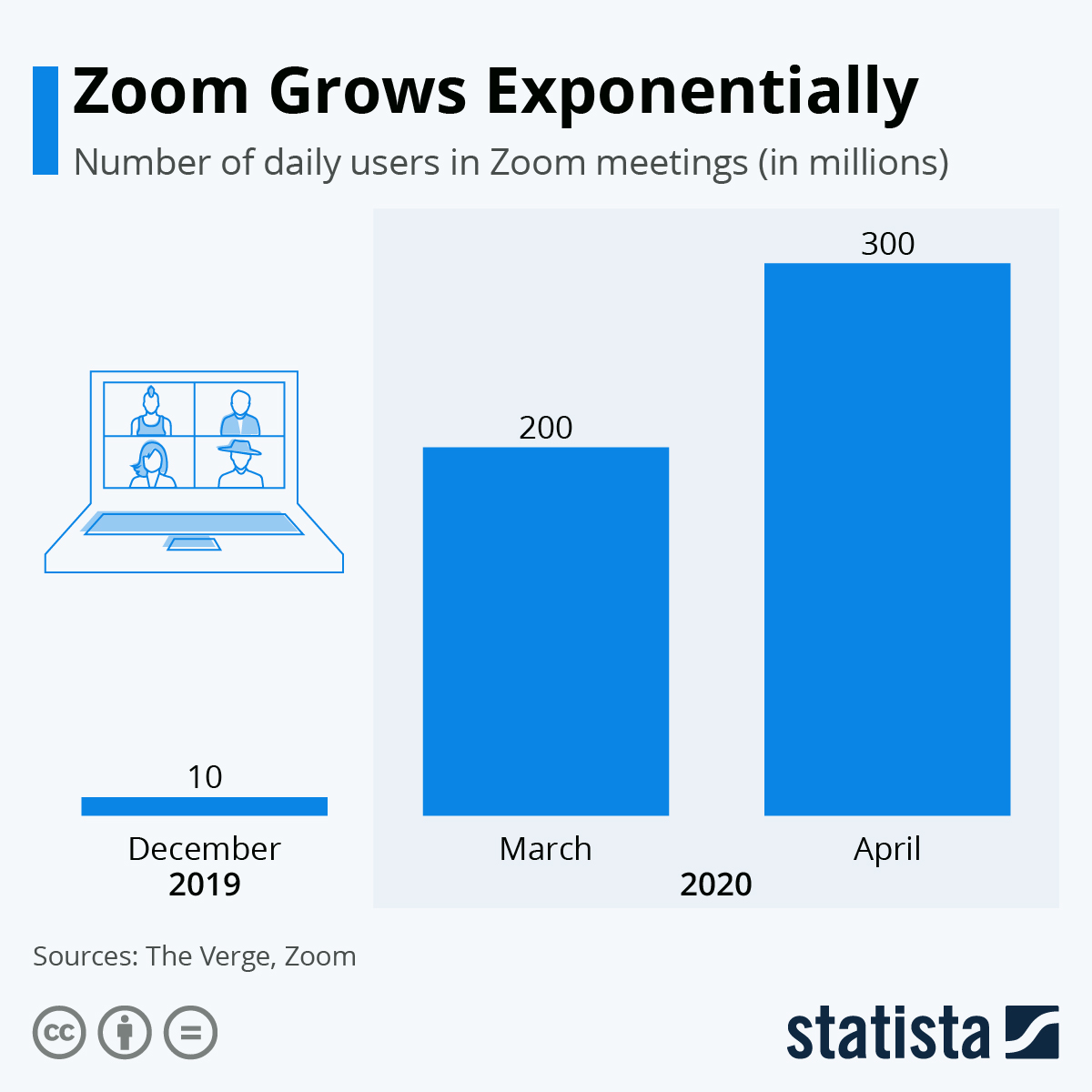

Zoom released data showing a massive surge in daily active users in meetings to 300 million, this number was less than 10 million at the beginning of January 2020 meaning Zoom has seen a 30 times increase in four months. Then between March and April it grew 50%, off of an already expanded base.

This is not something that has been unique to Zoom during this pandemic. Other productivity apps are doing well too. I wrote about Microsoft Teams crossing over 44 million daily active users, up from 20 million in just a month. Slack saw its daily active user count breaching the 12.5 million mark all thanks to the new normal of working from home.

This has not been enough for me to go rushing to buy Zoom shares though. Facebook announced a new 50-person video conferencing app called Messenger Rooms to compete with Zoom. We know what Facebook is capable of after copying the Stories feature from Snapchat and applying it across all its platforms.

The edge that Facebook has over many businesses is a very strong balance sheet and an experienced team of developers. I would continue investing in Facebook over fly-by-night businesses like Zoom. The Zoom’s of the world will bring the technology, then Facebook will perfect it and apply it to their billions of active users.

You will find more infographics at Statista

You will find more infographics at Statista

Linkfest, Lap it up

Anyone decide that they want to get married after spending a month with their partner? It is surprising to see how quickly the public sector moved to update laws. Does anyone know what the law is in South Africa? – Zoom marriages are now legal in New York.

Physical distancing can be difficult in public settings. This park is creating a maze to assist people stay apart – This maze-like urban park is designed to keep everyone 6 feet apart.

Signing off

After the US market closes this evening we will get earnings from both Starbucks and Alphabet (Google). Then later this week there will also be numbers from Apple, Amazon and Stryker. The oil market continues to be volatile. This time it is due to big ETF providers shifting around their positions. Interestingly, BP reported that their break-even oil price will drop from $56 to $35. The Rand looks a bit stronger this morning, now trading at $/R18.81.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063